Investor relations

The Company continuing to engage in dialogue with a wide universe of investors and analysts. In 2024, the Company maintained the same level of public disclosure, using an array of disclosure tools, including press releases, presentations, annual and sustainability reports, corporate action notices, as well as interactive tools. Nornickel provides disclosure both in Russian and in English. Materials for investors are available in the Investors section of the Company website.

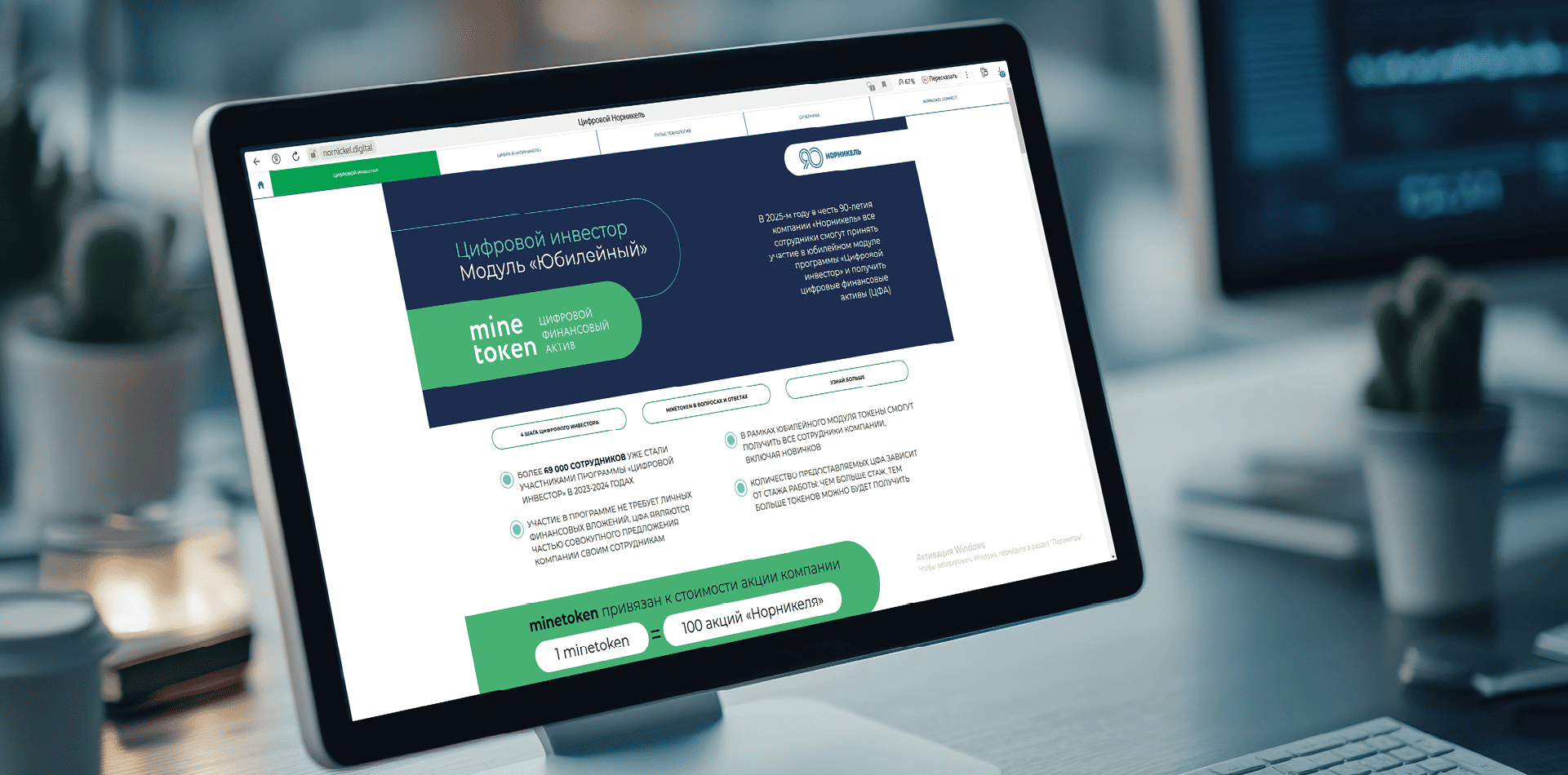

In 2024, Nornickel did a share split to boost its stock’s liquidity and make Company shares more accessible to a wider range of retail investors. We believe that this move will contribute to further expansion of Nornickel’s shareholder base and the growth of the Russian stock market more broadly. This is particularly important because during the first phase of the Digital Investor corporate incentive programme almost all Nornickel employees received digital financial assets (DFAs) whose value was linked to the market value of Nornickel shares.

Materials for investors are available in the Investors section of the Company website.

Shareholder and analyst engagement channels

Corporate website

Regular disclosures and updates in Russian and in English

General Meetings of Shareholders

General Meetings of Shareholders held on a regular basis

Capital Markets Day

Public presentation of the Company’s strategy

Participation in conferences

Participating in conferences for retail and institutional investors

Conference calls / one‑on‑one meetings

Video conference calls and webinars on published reports, trading updates, and announcements

Site visits to the Company’s production facilities

Organising site visits for investors and analysts to the Company’s production facilities

Online platforms

Nornickel’s presence on professional platforms for retail investors such as Pulse, Profit, and SMART‑LAB

60

In 2024, the number of retail investors exceeded 479 thousand, accounting for 12.8% in Nornickel’s shareholding structure. Growing the number of retail investors and their share in the Company’s authorised capital to 25% remains a strategic priority.

During the year, Nornickel continued to actively deliver on its retail investor strategy:

- Nornickel’s presence on retail investor social networks: focusing on accounts across professional platforms Pulse, Profit, and SMART‑LAB to engage with market participants. Nornickel’s blog is among the top 10 most visited account profiles across all platforms

- Leveraging information channels: participating in webinars, podcasts, video conferences with brokers, live broadcasts with bloggers, and conferences in Telegram channels

- Creating educational content: publishing analytical reports in Russian on the non‑ferrous metals market (metals market review) and holding the youth forum on financial literacy, Healthy Finance in Bobrovy Log: Invest Smartly

- Participating in dedicated conferences for retail investors: Russia Calling!, SMART‑LAB, and PROFIT CONF annual conferences, and ATON industry conferences

- Engaging prime customers in the private and premium banking segments: holding meetings with prime customers of major Russian banks

Nornickel views promoting financial literacy among school and university students as one of its priorities. In a first for the Company, young employees acted as partners and co‑organisers of the Healthy Finance at Biryusa project. As part of the We Are Professionals track of the Biryusa Territory of Proactive Youth forum, the Company organised a financial literacy crash course led by top specialists and stock market professionals.

In September 2024, Nornickel supported the second youth forum on financial literacy, Healthy Finance in Bobrovy Log: Invest Smartly. This educational event is organised for graduate students, where participants can update their financial literacy and build financial management skills through public talks and short presentations. The forum’s objective is to give young people essential knowledge about the basics of investing in a fun way and to demonstrate that a competent and balanced approach can make investments a reliable source of income. In the reporting year, the focus was on cybersecurity and digital financial assets. Students also learned how to build a securities portfolio, take their first steps in investing, and much more. Experts, analysts, and bloggers spoke to school graduates and university students about financial literacy and shared useful tips on managing personal finances and investments. More than 300 people attended the event, and about 10 thousand people watched the online broadcast of the forum.