Distribution

The Company’s products comply with national and international quality standards.

Despite geopolitical challenges and related logistical issues, the Company successfully met all its obligations to customers in 2024, having never failed to deliver on its commitments. This solid performance was to a large extent driven by Nornickel’s long‑standing policy and building direct relationships with market players.

In 2024, the Company’s products were supplied to key metal‑consuming countries.

Nornickel metals’ applications

Machine building, chemical and petrochemical industries, construction, and production of household appliances and cutlery.

Nickel is used in stainless steel production. Adding nickel as an alloying element to stabilise the austenitic structure enhances steel’s corrosion resistance, high‑temperature strength, weldability, ductility, and resistance to aggressive environments

Aerospace industry

Nickel‑based heat‑resistant alloys offer strong resistance to aggressive environments and are used in the production of aircraft engine components

EV batteries

Nickel is a key element used in the production of precursor cathode active materials for EV batteries. Nickel‑intensive NCM and NCA batteries are considered the dominant technologies due to their higher gravimetric and volumetric energy density, which increases driving range. Nickel‑based batteries are also more suitable for recycling and reuse than other types of battery systems

Renewable energy

Nickel alloys are used in wind, solar, and geothermal energy generation

Automotive industry

Palladium, platinum, and rhodium are used as active materials in automotive exhaust gas catalysts to minimise the vehicles’ environmental impact

Hydrogen solutions

Platinum, palladium, iridium, and ruthenium are widely used in rapidly developing hydrogen technologies. Platinum group metals are used as catalysts in low‑carbon hydrogen production as well as in hydrogen purification, transportation, and use as an energy source in fuel cells.

Chemical and petrochemical industries

Palladium, platinum, and rhodium are used as catalysts in chemical and petrochemical processes, helping industry players achieve high operational efficiency

Jewellery

Palladium and platinum are used to make a wide range of jewellery that stands out not only for its beauty but also for its safety, durability, andhigh value

Electronics

Palladium is used in the production of capacitors, motherboards, and other electronic components, while platinum is primarily used in hard drives, and rhodium in coatings for connectors and contacts

Healthcare

PGMs are extensively used as catalysts in pharmaceutical synthesis. Palladium has also found wide application in dentistry, while platinum is used in medical devices such as pacemakers and as an active ingredient in anti‑cancer medicines

Glass fibre and optical glass

In the glass industry, platinum and rhodium are used to manufacture bushings for making glass fibre and optical glass

Network infrastructure

Copper is used in power generation, transmission, and distribution as well as in all types of electrical wiring A strong push for transport electrification and transition to renewable energy will require a significant expansion of distribution networks

Construction and air conditioning and cooling systems

The construction sector uses copper in pipes and tubing, heating and cooling systems, and as a cladding material. Electrical and communication cables are also mostly made of copper

Renewable energy

Copper is widely used in the construction of wind, solar, and other types of renewable power plants

Electronics and home appliances

Copper is used in electronics and home appliances owing to its superior electrical and thermal conductivity

Automotive industry

The automotive industry uses copper in batteries, electric motors, inverters, wiring, and charging infrastructure. Transport electrification is expected to be a key driver of copper demand throughout the current decade

Sales and distribution strategy

As the world’s largest producer of several metals, Nornickel views sales and distribution as a key pillar of its business, on par with production. The key objective of sales and distribution is to ensure current and future liquidity across the entire product range.

The Group sells its products globally both through its own sales offices in Europe, China, and Russia and via distributors in other regions.

Nornickel’s products are registered on major global commodity exchanges. In particular, the Foreign site passed an audit in 2024 confirming compliance with the LME Responsible Sourcing requirements and maintained its LME brand registration.

Group products by site

Norilsk site:

- Copper cathodes;

- Сopper concentrate;

- Commercial sulphur;

- Selenium;

- Precious metals.

Kola site:

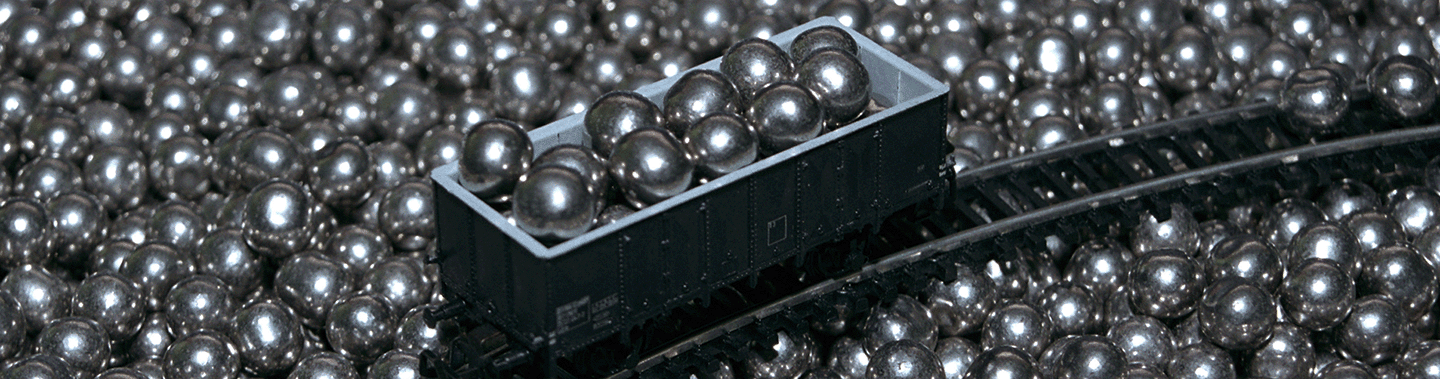

- Nickel cathodes and carbonyl;

- Nickel sulphide concentrate;

- Nickel carbonate and sulfate;

- Nickel matte;

- Nickel salts;

- Copper matte;

- Cobalt cathodes, cobalt concentrate;

- Precious metals;

- Sulphuric acid.

Foreign site:

- Nickel salts, briquettes, cathodes, and powders;

- Copper cake;

- Cobalt sulphate, cobalt solutions.

Trans‑Baikal Division:

- Iron ore concentrate;

- Copper concentrate.

The Company’s market reach enables it to respond promptly to evolving demands in terms of product quality and services as well as to changes in the market environment and other external conditions affecting sales and distribution. Nornickel favours direct sales to industrial customers, while also engaging other professional market participants willing to partner with the Company to promote its products.

Nornickel has traditionally positioned itself as a responsible supplier committed to the sustainable development of end markets for its core products and not seeking to benefit from its market position to the detriment of other participants. Regardless of external conditions, consumers can rely on Nornickel for a stable supply and unrestricted access to consistent‑quality products in volumes that meet market demand.

Nickel sales and distribution strategy

The Company’s nickel product sales mix matches the global nickel consumption profile, where the key end‑use segments include stainless and specialty steel production, alloy manufacturing, and electroplating. The battery sector is also growing in importance.

To capture the expected mid‑ and long‑term growth in nickel demand from the battery sector, Nornickel continues to implement a number of initiatives to enhance and expand its existing product range supporting the battery supply chain. The significant increase in Indonesian nickel supply may become a limiting factor for the implementation of these initiatives. Nevertheless, the competitive advantages of Norilsk Nickel products, such as their low carbon footprint and full compliance with internationally recognised environmental standards, support the Company’s continued presence in market segments that traditionally prioritise these qualities, particularly in sustainable electric vehicle production.

The sales and distribution strategy for nickel products is aimed at striking a healthy balance between supplies to stainless steel producers and deliveries to other industries, thereby ensuring the Group’s stable sales performance amid shifting consumption trends in end‑use markets.

In recent years, the battery sector has been the fastest‑growing end‑use segment. The Company is strongly focused on building long‑term relationships with key market participants and explores various forms of cooperation with consumers in the battery sector. Nornickel also conducts research in battery recycling and works on developing integrated solutions for the future battery supply chain.

In the alloys, special steels, and electroplating sectors, the Company aims to fully leverage the strengths of its product portfolio and enhance product quality to expand its presence in premium segments with high quality requirements.

PGM sales and distribution strategy

The automotive industry, the production of process catalysts, as well as the jewellery and medical products industries, have traditionally remained the key market segments for platinum group metal (PGM) products.

As the world’s largest producer of palladium, the Company continues to focus on developing relationships with major end users and key market participants to support long‑term and sustainable demand. At the same time, Nornickel takes part in various initiatives aimed at further promoting the use of palladium in various future industrial applications. Among other initiatives, Nornickel is actively developing palladium‑based solutions for emerging technologies, including hydrogen energy, advanced chemistry, solar power, and other areas that have the potential to expand the metal’s applications going forward.

Product quality

In 2024, Nornickel once again reaffirmed its reputation as a reliable supplier of high‑quality products. The Company places top priority on delivering high‑quality products and related services to maximise customer satisfaction. The Company’s products comply with national and international quality standards. Nornickel’s production sites have established procedures during both the manufacturing process and final product release to manage non‑conforming products and prevent their delivery to customers. The handling of such products, responses to customer complaints, and corrective actions are carried out in accordance with documented procedures compliant with ISO 9001:2015. With regard to product acceptance by consumers, the Company follows the instruction on the procedure for acceptance of products by quantity and quality, as well as the product supply contract.

All of the Company’s products are certified, with safety certificates issued that set out product‑specific requirements for transportation and handling.

The Company successfully maintains certification to international standards such as ISO 9001 (quality management), ISO 45001 (occupational health and safety management), ISO 14001 (environmental management), and ISO/IEC 27001 (information security management).

In line with the principles of transparency and openness in disclosing product quality information to consumers and other stakeholders, up‑to‑date data on the physical and chemical properties of the Company’s products is available in the Products section of the Company’s website.

| Indicators | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Total customer complaints and queries regarding product quality | 22 | 18 | 16 | 27 | 30 |

| Of which were substantiated | 7 | 10 | 3 | 13 | 6 |

Customer satisfaction

Every year, the Company conducts a customer satisfaction survey in line with ISO 9001 to collect feedback from its customers. The feedback received is reviewed and incorporated into initiatives to improve product and service quality.

Nornickel is committed to continuous improvement. The integrated index of customer satisfaction with the Company’s products and services was fully in line with our target for 2024.

Customer satisfaction is measured and assessed using a numerical satisfaction score. The evaluation is based on criteria that reflect the quality attributes of the Company’s products and services. Each criterion is evaluated using the following scale: 3 points — the customer is fully satisfied; 2 points — the customer is partially satisfied; 1 point — the customer is not satisfied with the quality of the Company’s products and services.

During the reporting period, Nornickel retained most of its customer base and established new partnerships in new markets, promptly adding new clients to its portfolio.

Consumer personal data protection

Personal data protection at Nornickel is governed by the Personal Data Processing and Security Methodology and the Personal Data Processing Policy, both developed in line with legal requirements. Documents provided by consumers and containing personal data, among other information, are stored in the information system in compliance with relevant data protection regulations. In 2024, there were no data‑related incidents involving consumers’ personal data.