Investment highlights

Unique resources

Copper‑nickel sulphide ore

Polar Division

7 mines

Proven and probable reserves

1373 mln t

Measured and indicated resources

1995 mln t

Reserves life at the current production rate

Over 70 years

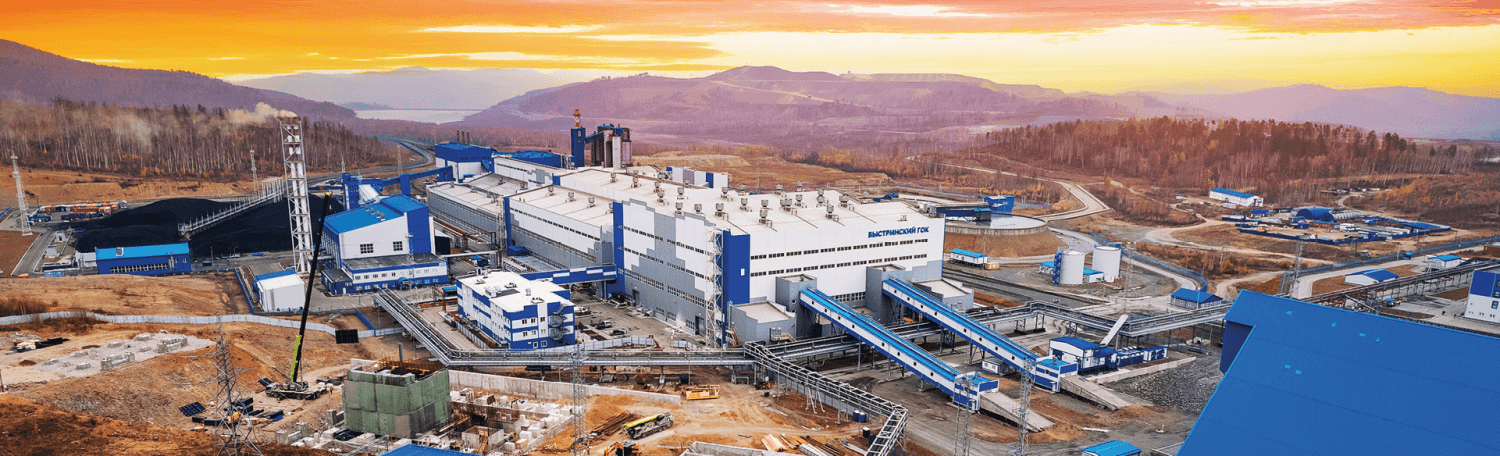

Gold‑iron‑copper ore

Trans‑Baikal Division

2 open pits

Proven and probable reserves

272 mln t

Measured and indicated resources

292 mln t

Reserves life at the current production rate

Over 20 years

Position in the global metals market

Highly liquid stock

Nornickel shares have been traded on the Russian stock market since 2001. Since 2014, Nornickel shares have been included in the first‑level quotation list of the Moscow Exchange (ticker: GMKN).

Proportion of Nornickel shares in the main indices of the Moscow Exchange: